If you believe tokenization is difficult, try tokenizing with us first.

Let’s take a deep dive into the “SIX Network Tokenization Framework.”

Key Highlights

• The challenges of tokenization

• SIX Network’s tokenization framework

The process of RWA Tokenization is not something that can be easily built or developed independently. It involves multiple complex steps in order to successfully create a token issuance project for different types of assets.

Challenges of Tokenization

• Strict Regulatory Compliance

One of the biggest challenges lies in regulatory compliance across different jurisdictions. Some countries have not yet officially enabled RWA tokenization, while others impose strict requirements that projects may not initially meet. As a result, licenses must be obtained or project structures must be adjusted to align with legal frameworks, processes that are both complex and time-consuming.

• Customization Gap

Designing and building a successful tokenization structure can be one of the most difficult steps, especially for traditional companies attempting to develop tokenization projects on their own.

• UX & Wallet Experience Still a Barrier

The digital experience of many projects remains difficult for general users to access, making RWA tokenization feel distant and unfamiliar to the broader market.

• Fragmented Infrastructure

Tokenization-related systems remain fragmented across legal frameworks, asset data, financial systems, and blockchain infrastructure, making integration across these components highly complex.

Even for those within the Web3 industry, RWA remains a challenging space.

This is why specialized tools and experienced tokenization providers are essential to ensure projects can move forward efficiently and smoothly. It is therefore understandable why many perceive tokenization as difficult and inaccessible, often simply because they have not yet seen the SIX Network framework.

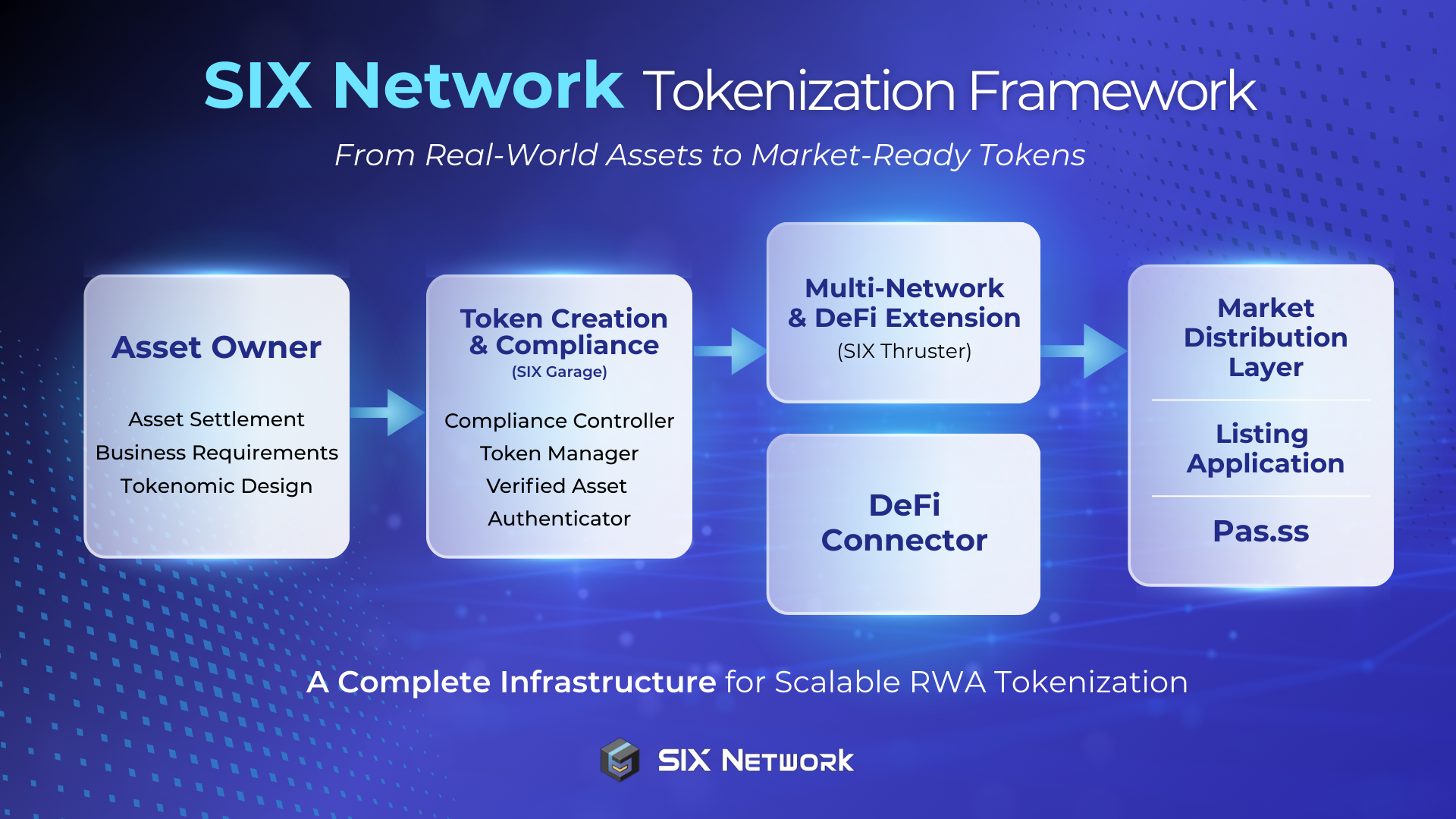

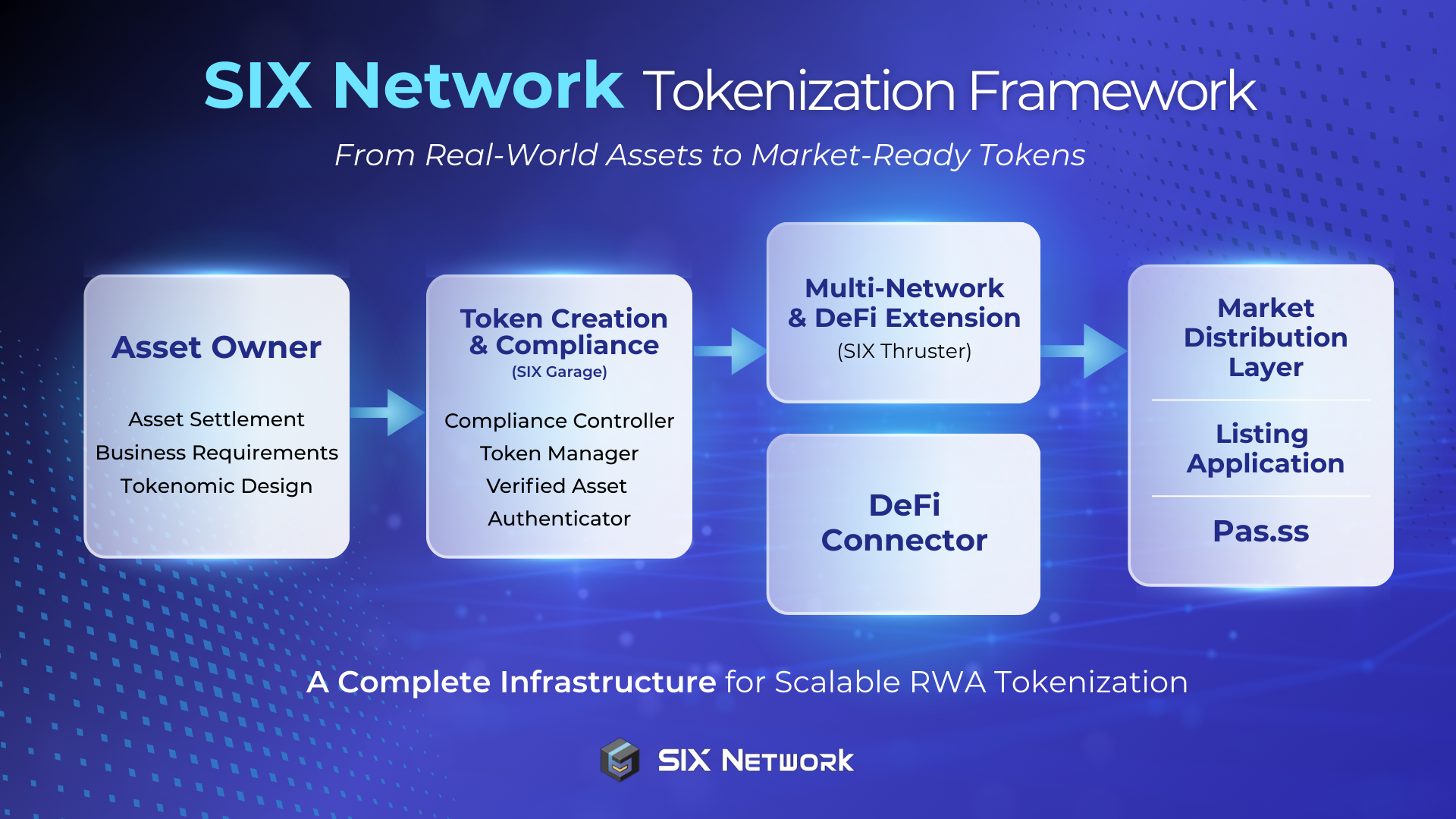

SIX Network Tokenization From Real-World Assets to Market-Ready Tokens

As a blockchain solutions provider specializing in RWA tokenization, SIX Network offers a comprehensive solution for transforming real-world assets into digital assets through a tool called SIX Garage, which was introduced during our 2025 roadmap live session.

We have designed a complete tokenization structure

from start to finish as follows.

SIX Network Tokenization Framework

A structured approach to preparing digital assets for token issuance, from start to finish.

📝 Starting with the Asset Owner

The first step involves working closely with asset owners or businesses to gather and analyze business requirements comprehensively.

This stage covers:

• Defining asset ownership structures and settlement mechanisms

• Designing tokenomics aligned with revenue models and investment strategies

🧑🏻🔧 Creation Stage

Once requirements are clearly defined, the process moves into the Creation stage.

Token Creation marks the official start of tokenization, entering the “race track.”

Key components of this stage include:

• Compliance Controller: A system that enforces regulatory requirements such as age restrictions, investor types, and jurisdiction-based rules to ensure full legal compliance.

• Token Management: Managing token rights and conditions, including transfer restrictions, eligibility rules, age requirements, and country-based access controls.

• Asset Verification & Authenticator: A critical step to verify the authenticity and legitimacy of real-world assets before tokenization, along with identity and permission verification for both issuers and token holders to ensure security and trust.

🌬️ Thruster: Accelerating Tokenization

After tokens are created, they require a powerful engine to accelerate performance on the track, this is where Thruster comes in.

Thruster consists of Multi-Network support, DeFi Extensions, and DeFi Connectors, enabling tokens to connect seamlessly across multiple blockchains and financial systems. This layer enhances scalability, usability, and liquidity for tokenized assets.

🏎️ Entering the Market

The final phase involves bringing tokens into real trading environments.

SIX Network does not perform this step alone, we collaborate with licensed third-party partners specializing in token listing and sales to ensure regulatory compliance and market readiness.

🏁 Crossing the Finish Line

Once tokens are officially launched or fundraising is successfully completed, the project reaches the finish line. The next step is distributing returns, such as dividends or project benefits, through Pas.ss, ensuring transparent and systematic reward distribution to token holders.

──────────────────────────────────

SIX Network is ready to provide end-to-end tokenization services, transforming real-world assets into digital assets with enterprise-grade blockchain infrastructure designed for institutional and large-scale projects.

For organizations interested in tokenization or integration

with the SIX Protocol, please contact us at 👉🏼 https://zeeg.me/sixnetwork